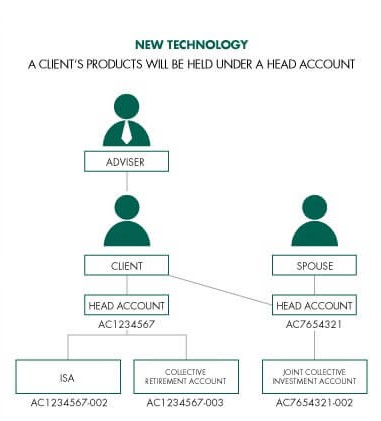

Our platform links your client’s accounts or bonds together under a single customer reference or ‘Head Account’. This is similar to our previous account structure, where all accounts and bonds fall under a client’s ‘customer reference number’, now with the benefit of being able to automatically link assets between family members.

Understanding the ‘Head Account’ structure

How accounts or bonds are linked

The Head Account will have accounts or bonds linked directly to it, which are then given their own reference number, for example 001, 002, 003 (see part 2 below). The first part of the account reference is the same for all accounts under the same Head Account.

| Account | Part 1 | Part 2 | ||

| ISA | - | A C 1 2 3 4 5 6 7 | - | 0 0 2 |

| CRA | - | A C 1 2 3 4 5 6 7 | - | 0 0 3 |

Multiple head accounts

There will be some clients that have two customer references (Head Accounts). Some of these were created following migration to our current technology, but they can also be created inadvertently.

When a client has multiple Head Accounts it means that:

- Because we issue statements based on each customer reference (Head Account), investors with more than one customer reference will receive more than one set of statements covering the accounts held under each reference. These will be issued based upon the anniversary date of the first account that was opened under each separate customer reference.

- Any reports created in the new system, such as from Uscan, will be done at Head Account level and therefore you may require a number of reports to encompass all of a client’s investments.

- Customers may miss out on benefits such as family linking and therefore aggregated platform charge discounts.

It also has implications on us, in our treatment of those separate accounts from a client money perspective.

Scenarios

The scenarios where customers were migrated with multiple Head Accounts include:

- Multiple ISAs on the previous system, for example they held an ISA and an ISA (formerly PEP).

- Multiple CRAs on the previous system, for example they may have held multiple crystallised or uncrystallised accounts designated for different purposes.

- Clients with accounts under two different advisers at the same firm.

There are two scenarios where you may inadvertently create multiple Head Accounts:

Scenario 1

You are giving advice to a client who you don’t normally look after, and they already have an account(s) set up with us. A new Head Account is created if business is submitted by another adviser.

How to prevent a second Head Account being created

Please liaise with other advisers in your firm when you/they are giving specialist advice to one of your firm’s clients and if possible you can assign the client to the new adviser before setting up the account. Where a client needs to have different advisers on two or more different accounts, on setting up the new account(s), a new Head Account will always be created.

Scenario 2

You inadvertently set up a new client record when setting up an account for a client. Perhaps you are unaware they already had an account or you did so when processing new business following a quick quote or similar process.

How to prevent a second Head Account being created

Please always check whether a client has an existing record before setting up a new client account. When setting up clients on the new system please do not hesitate to contact us if you are unsure on any of the points above and we will help guide you through this process.