Maintaining and winning trust

Investors will have lots of questions during this period of market uncertainty. As a trusted source your existing clients will naturally turn to you, so its important to keep talking to them. Even when the answers to some of their questions ie disappointing performance due to markets, aren’t always positive.

For new clients, even during a more normal environment, this can be more difficult as you may not have had the opportunity to build the same level of trust with them. However, in a world of ‘social distancing’, your ability to build trust becomes even harder as this now needs to be delivered in a 2- dimensional way through a screen.

Accelerating trust with clients

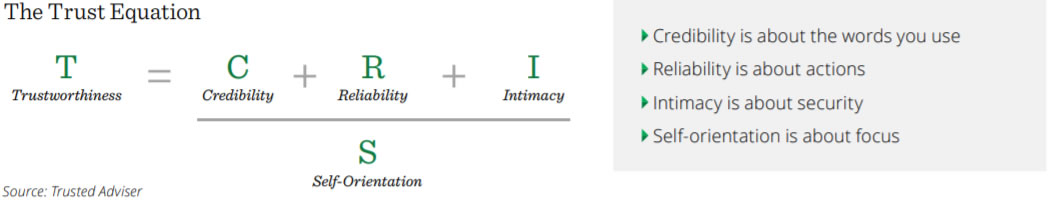

The principles behind earning and maintaining trust are in fact the same for existing as well as new clients. At Quilter we’ve developed a Guide For Accelerating Trust With Clients Remotely based around the Trust Equation. These 4 steps have been based on learnings and real-life observations of firms who are successfully embracing these methods and building greater trust. We hope you find this useful.

Step 1 – intimacy and security

When a client first engages with you, they need to feel safe and happy to share their personal information. In a remote environment, they may feel more concerned doing this. So, what can you do?

Personalise the email template that best matches your preferred technology application (e.g. Zoom) to send to your client allaying any fears around security. We’ve developed a 3 step guide to Zoom that you can download to reassure clients they don’t need to be an IT expert to use it. You can of course adapt this for any video software package.

Step 2 – Building credibility

Enhance your welcome pack by including your biography. This is your CV to ensure you get the job. Include a picture of yourself, so that they can recognise you when you first meet each other (on screen).

Detail your credentials, your qualifications, your areas of specialism and which professional bodies you belong to. All this adds to your credibility. As well as your biography, make sure that your website, LinkedIn profile and Google searches contain the most up to date information.

To help you do this we’ve developed a biography template for you to download.

Step 3 – Demonstrating reliability

This is about showing that you do what you say you’ll do. By having a meeting framework to follow, that clients can mentally tick off as completed, you can help demonstrate your willingness to deliver against stated topics.

It also helps to focus on the client’s needs - and not your own. You can download your own copy of a Client Meeting Framework template.

Step 4 – Lowering self-orientation

While we all want to promote our own ‘brand’ with clients, our experience has shown that this can be amplified by using third party materials. This not only helps to mitigate any cynicism in being seen as only sending information that supports your own message, but it also enhances the credibility of your argument by demonstrating impartiality.

Consider using authoritative sources such as:

Money Helper – articles on pensions https://www.moneyhelper.org.uk/en/pensions-and-retirement

The Financial Conduct Authority – the regulator’s view on what to ask an adviser

https://www.fca.org.uk/consumers/what-ask-adviser

Sending these types of resources separately in an ‘I saw this and thought of you’ way, is a powerful technique often used to accelerate trust.

In summary

In this changed world of Covid-19 and ‘social distancing’, learning to build trust remotely with new clients is a critical skill. However, despite all these difficulties you can still take simple steps to amplify and accelerate trust with new (and existing) clients.

By using a variety of templates and techniques that we’re able to share with you, you can not only help to maintain and grow your business, but by enhancing the way you engage with clients you can build greater business resilience for the future.