A simple view for order of gifting with PET’s and CLT’s during lifetime and the impact upon death

Many articles have been written discussing the order of gifting and the effect, or potential effect, this can have on both the estate and the trust. These two elements would also then need to be looked at in terms of the lifetime and death of the original donor. This is because something that looks beneficial in one scenario could have other implications if that scenario changes, i.e. life and death within 7 years of making the gift.

A simple summary

Here we provide a simple summary of the many different scenarios and the potential tax consequences based on the order a donor makes an outright gift as a potentially exempt transfer (PET) or a chargeable lifetime transfer (CLT). This is a simplified guide to these scenarios and should be used for quick reference reasons only.

During life

- If the donor makes a PET first and then a subsequent gift into a discretionary trust (CLT) only the CLT would be looked at for entry charges within the 7 year period.

- If the donor makes a CLT and this was then followed by another CLT within the 7 year period, the first CLT would be tested against the available nil rate-band. The second CLT would take into consideration the first CLT value as well as its own value at the time to see if an entry charge would apply.

E.g. First CLT £175k, when tested against the nil rate band within the £325k allowance. Second CLT made 5 years later for £200k. For entry charge purposes would take into consideration the initial CLT of £175k, as within 7 years, and the new CLT of £200k, so total of £375k leaving £50k over the nil rate band subject to tax at half the standard rate of IHT, so £50k x 20% = £10,000 charge.

- If the donor has only made PETs in the 7 year period, irrespective of how many have been made they will not create any initial tax charge during lifetime.

- If the donor makes a CLT and follows this by a PET within the 7 year period, the CLT would obviously be tested against the nil rate-band but the later PET would not be tested against any bands.

On Death

- If the donor made a PET and this was followed by a CLT and then the donor died all within 7 years.

- The PET failed as this was made within 7 years of death and so the PET will be looked at as a CLT. This failed PET will be added to the later CLT to see if this breaches the nil rate-band. If the nil rate-band is breached any excess will be subject to IHT at 40% (or at 20% if there has been an entry charge on that portion).

For simplicity, the following examples have been created listing the total investments to show the tax outcome when doing these calculations. In reality you would apply the same process to each gift made in turn.

Example:

A PET of £300k is made in year 1, a CLT of £200k in year 4 and death occurred in year 6. You look at the CLT of £200k (as this is the element that will have a potential entry charge) and add the failed PET of £300k = £500k. This is £175k over the nil rate band (assuming the nil rate band at the point of death is £325k) and so 40% tax to pay on the excess. Tapering may apply if the gift was made more than 2 years previous.

- The 10 year periodic charge applicable to discretionary trusts will take into consideration any chargeable transfers made at the creation date of the trust and the 7 years prior to the creation date. Here any failed PET will be seen as a CLT.

Example of the periodic charge:

A donor dies leaving a failed PET of £300K and a CLT of £200 respectively equalling £500k (note. You will look at the current CLT value as this is what the periodic charge is being calculated on but only at the initial value of the failed PET (“historic cost”) so any growth on this asset would be ignored).

£500k – nil rate band of £325k = £175k

Lifetime rate (£175k x 20%) = £35k

Effective tax rate (£35k/£200k) x 30% = 5.25%

Tax due (£200k x 5.25%) = £10,500

- If the donor made a CLT and followed this with another CLT, and then the client died all within 7 years.

- The same rules will apply as illustrated above for a PET followed by a CLT for both death and the ten year periodic charge calculations.

- If the donor made a CLT first and followed this with a PET and then died all within 7 years.

- For death both the CLT and the PET will be tested against the clients nil rate band. As the PET was made second but was within 7 years of the death of the donor, this would be treated as a failed PET (i.e. like a CLT) and therefore would take into consideration the first CLT as well when calculating any excess over the nil rate band.

Example:

The CLT was valued at £300k and the later PET was valued at £200k when looking at the 7 years from death you would look at the CLT first and then add the failed PET (as this was the last action). £300k plus £200k = £500k - £175 over the applicable nil rate band. As the failed PET was the last action it is this process it is this asset that has the 40% IHT liability applied to it. As the nil rate band is breached tapering relief may apply depending on when the gift was made.Within the periodic charge calculations, the PET would be ignored as this was made after the CLT.

The 14 year rule on death

As we know, upon death you will look back 7 years to see if there are any gifts made (either CLT’s or PET’s) that may be pulled back into the donors estate for inheritance tax purposes. However, there is an additional rule that applies to PET’s which needs to be considered. When a PET is made there is no consideration given to any other gift that has been made at that time. However, if the donor was to die within 7 years of making the PET, to ensure that HMRC can give consideration to liabilities that had previously been missed, a special process would need to be entered into.

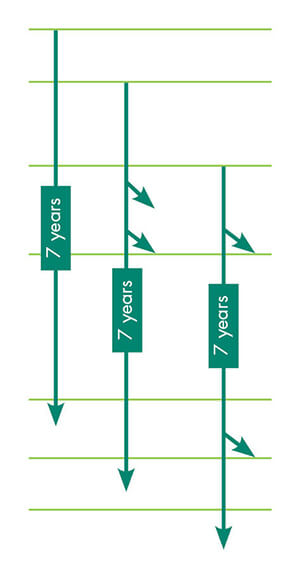

To ensure all tax liabilities are picked up there is a special rule that requires any failed PET within the 7 years of death to look back an additional 7 years to pull in any CLT’s to determine if there is a tax liability on the failed PET. This would also obviously pick up any other PET’s made within 7 years of death.The diagram below illustrates how upon death you would look back 7 years to pick up the CLT’s and PET’s and then how the PET’s (now failed PET’s) can look back another 7 years. Note this diagram does not show how the taxation of each PET and CLT works and is only designed to show the gifts that need to be considered.

Example of how Failed PETs utilise the 7 year exemption

Summary of the gifts and dates shown below; 1st Jan 2006 CLT £20,000, 11th Sept 2007 CLT £265,000, 1st Nov 2009 PET £400,000, 1st Jan 2012 CLT £50,000, 15th Jan 2013 PET £100,000, 12th Sept 2014 PET £150,000.

- 11th November 2016. Client died.

- 12th September 2014. PET (failed as within 7 years of death) £150,000.

Calculation would be last 7 years, so £150,000 + £100,000 + £50,000 = £300,000 – no tax

- 15th January 2013. PET (failed as within 7 years of death) £100,000. Calculation would be last 7 years so £100,000 + £50,000 + £265,000 = £415,000

- 1st January 2012. CLT into a discretionary trust £50,000.

Calculation would be just look at the CLT of £50,000.

11th November 2009 – 7 year cut off point from death

- 1st November 2009 PET £400,000. Outside of 7 years so now ignored

- 11th September 2007 CLT £265,000.

- 1st January 2006 CLT £20,000.

Not caught for these calculations as outside 14 years.